When your employer’s contractors let you down

One senior manager speaks about how MiP helped her after a frustrating and costly experience with her employer’s outsourced leased car scheme.

Paying people the right amount at the right time is perhaps the most basic duty for any employer. Yes, complicated tax rules mean pay isn’t always straightforward – but employers have a responsibility to sort out mistakes as efficiently as possible, and not put hardworking staff under the additional stress of financial uncertainty. That’s what payroll departments are for. Sadly, not all NHS employers take this responsibility as seriously as they should.

Salary sacrifice

Lucy, a manager working for a community trust, was persuaded to join a new “salary sacrifice” leased car scheme after her employer ended its previous salary deduction scheme. “They produced this lovely booklet where you could go through and choose your car, and it explained how it all worked,” explains Lucy. “I found out afterwards, there was a tiny, tiny line that said something about considering the HMRC tax rules for company cars, but that wasn’t included in the financial illustrations, and I had no idea at the time of the impact it would have on me.”

With salary sacrifice schemes, you agree to reduce your salary in return for a benefit, supposedly resulting in lower tax and national insurance payments. Generally, such schemes only reward employees when the benefits are tax free – childcare, for example – but with taxable benefits like company cars, employees can find themselves seriously out of pocket.

“I didn’t understand why I suddenly had loads of tax to pay,” says Lucy. “It was significantly different from the salary deduction scheme in several ways, but nowhere in the financial information did it tell me this, so I was unable to accurately compare the two schemes.”

Payroll errors

After two years, Lucy downgraded to a smaller car to save money. Despite immediately updating her details with HMRC, a series of errors by her payroll department – outsourced to NHS Shared Business Services (SBS) – led to unpredictable changes in her monthly pay.

“I was getting tax codes issued every few weeks, and my tax allowance was whittling down to virtually zero,” explains Lucy. “Every year for the last four years, my pay has been incorrect because of errors made by SBS.”

In the midst of all this, Lucy took time off work for an operation and an employment break to care for a sick relative. “It was an incredibly stressful time for me and I thought I just don’t need this now,” says Lucy. “I was trying to get my employer to take this seriously. I shouldn’t have had to deal with this on my own. I felt very let down by them and by SBS.”

In March, Lucy decided to withdraw from the scheme and hand back the keys to her car – a move which landed her with an additional £800 penalty.

Hands-off attitude

MiP national officer Jo Spear, who has been supporting Lucy, says such cases are now depressingly common. “We’re seeing this throughout the NHS – the outsourcing of services like payroll and occupational health to cheap but incompetent providers. What makes these cases particularly frustrating for staff is the hands-off attitude from employers when things go wrong.”

As a union rep, Jo was not allowed to to talk directly to HMRC or SBS, but helped Lucy to work out her options and put pressure on her employer to take responsibility for the failings of its payroll provider. Jo is also talking to the local staff side to see how the policy change on lease cars – which affects mainly managers like Lucy – came to be approved.

“The employer can’t evade their responsibilities to staff just because they’ve contracted the service out,” says Jo. “They have to take up the issue with SBS and make sure something’s done about it, as well as investigating why it happened in the first place.”

Lucy’s employer has now “escalated” her case and agreed that her pay will be closely monitored for the next 12 months. But Lucy says she will still be “on tenterhooks” when she opens her first payslip after returning to work in November. “I need to feel assured that they will get this right in the future, and they’re not just going to hope it will be right and then apologise afterwards – which is what’s been happening.”

If you’re experiencing problems with outsourced payroll or other services, speak to your MiP rep or national officer as soon as possible.

Related News

-

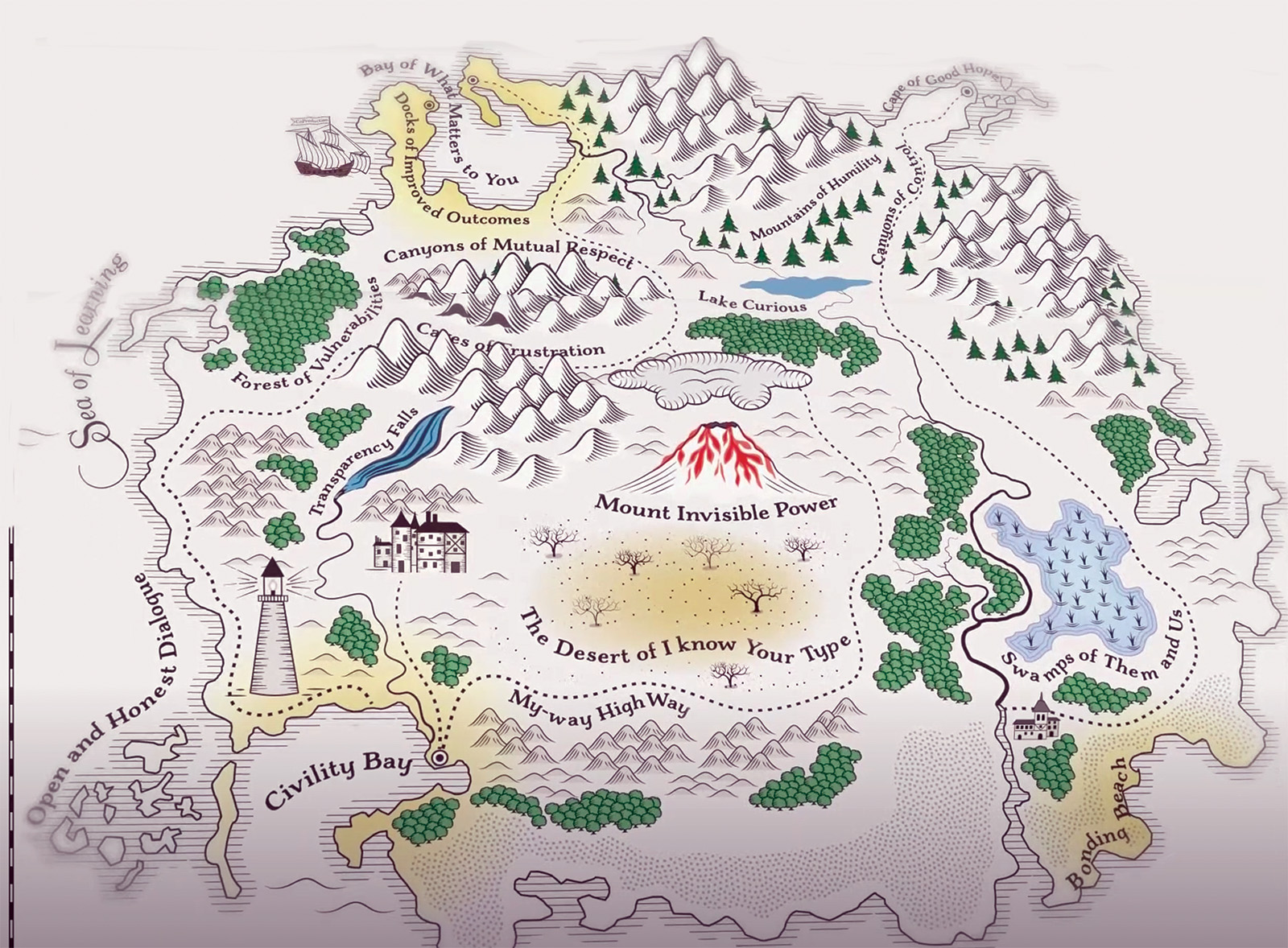

Co-production: say it like you mean it

The NHS talks a good game on co-production, but many patients and carers still feel service changes are done ‘to’ them not ‘with’ them. As Jessica Bradley discovers, meaningful co-production means building lasting relationships and sharing decision making power.

-

Holyrood elections: Back from the brink—for more of the same?

After a big scare last year, the SNP are now clear favourites to extend their rule at Holyrood into a third decade, pointing to incremental reform rather than radical change for the NHS in Scotland. Rhys McKenzie reports.

-

Senedd elections: Tough choices, empty promises

As we enter 2026, the NHS in Wales faces some stark choices and a likely change of government. But the parties vying for power at Cardiff Bay will need to up their game to meet the challenges ahead. Craig Ryan reports.